A business credit card works in a similar way to a personal credit card. They can be easy to apply for and come with comparable APRs. These cards are useful for small business owners who have trouble managing cash flow. They also offer easy access to credit, which is important when a business owner is trying to make ends meet.

Personal credit cards have lower APRs than business credit cards, but they offer similar APRs for business credit cards

Although it is similar to a personal or business credit card, it does have some limitations. First, the issuer may require a personal guarantee of the business. This makes the business owner personally liable for the debt, even if the business fails. It is crucial to learn the terms of the credit card.

Both types have similar rewards programs and terms. Both cards come with a credit limit. This is the maximum amount you can spend. As you make purchases, your credit limit will decrease and then increase as you pay off the balance. The only difference between the two is that the interest rates can be significantly increased by business credit card providers.

Credit checks are required.

Applying for a small business credit card is a decision that will require you to pass a credit screening. The credit card issuer will conduct a personal credit check to verify that you are a responsible borrower. Credit scores are an indicator of your financial history and will be used by credit card companies to determine if you can repay your debts.

There are several types and varieties of business credit cards. Some credit card companies will require you submit a personal promise. This means that your personal data will be shared with them. This could have a negative effect on your credit score, depending on what type of business card you are applying for.

They are simple to find

A business card can be used to support your company's operations. The application process is easy and usually takes less than five to ten mins. Make sure you do your research before applying. You need to have a high personal credit score in order to be approved.

A majority of business credit cards require that you have a personal credit score at least 650. It is best to wait before applying if your credit score is lower. Most applications can be done online in just a few minutes. Additional information may be required or follow-up may be necessary by the card issuer via phone or email.

They assist small business owners to manage their cash flow

Small business owners can use business credit cards to manage their cash flow in many ways. You can get cash back, 'pay back with point' or other programs to help you pay your monthly business expenses or reduce your balance. You can also earn points, which you can use to get rewards or bonuses. Some credit cards also offer tax benefits if you use them to pay for purchases. It's always a good idea to consult a tax professional to determine how much you can claim on these credit cards.

Business credit cards should not be used for large capital expenditures by small businesses. While business credit cards are great for covering short-term expenses, big purchases should be paid for separately with a business loan. These loans typically have lower interest rates.

FAQ

What should I expect from an accountant when I hire them?

Ask questions about the qualifications and experience of an accountant when you are looking to hire them.

You need someone who is experienced in this type of work and can explain the steps.

Ask them about any skills or knowledge they may have that could be of assistance to you.

Make sure that they are well-respected in the local community.

What does an auditor do exactly?

Auditors look for inconsistencies in financial statements and actual events.

He validates the accuracy of figures provided by companies.

He also confirms the accuracy of the financial statements.

What does it mean to reconcile accounts?

A reconciliation is the comparison of two sets. One set of numbers is called the source, and the other is called reconciled.

The source consists of actual figures, while the reconciled represents the figure that should be used.

You could, for example, subtract $50 from $100 if you owe $100 to someone.

This ensures the system doesn't make any mistakes.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

External Links

How To

How to do Bookkeeping

There are many different types of accounting software. While some are free and others cost money, most accounting software offers basic features like invoicing, billing inventory management, payroll processing and point-of-sale. Below is a short description of some common accounting packages.

Free Accounting Software: Free accounting software is usually offered for personal use only. Although the program is limited in functionality (e.g. it cannot be used to create your reports), it can often be very easy for anyone to use. If you are interested in analyzing your business' numbers, many programs allow you to directly download data to spreadsheets.

Paid Accounting Software: These accounts are for businesses that have multiple employees. These accounts are powerful and can be used to track sales and expenses and generate reports. Although most paid programs require a minimum of one year to subscribe, there are many companies that offer subscriptions for as little as six months.

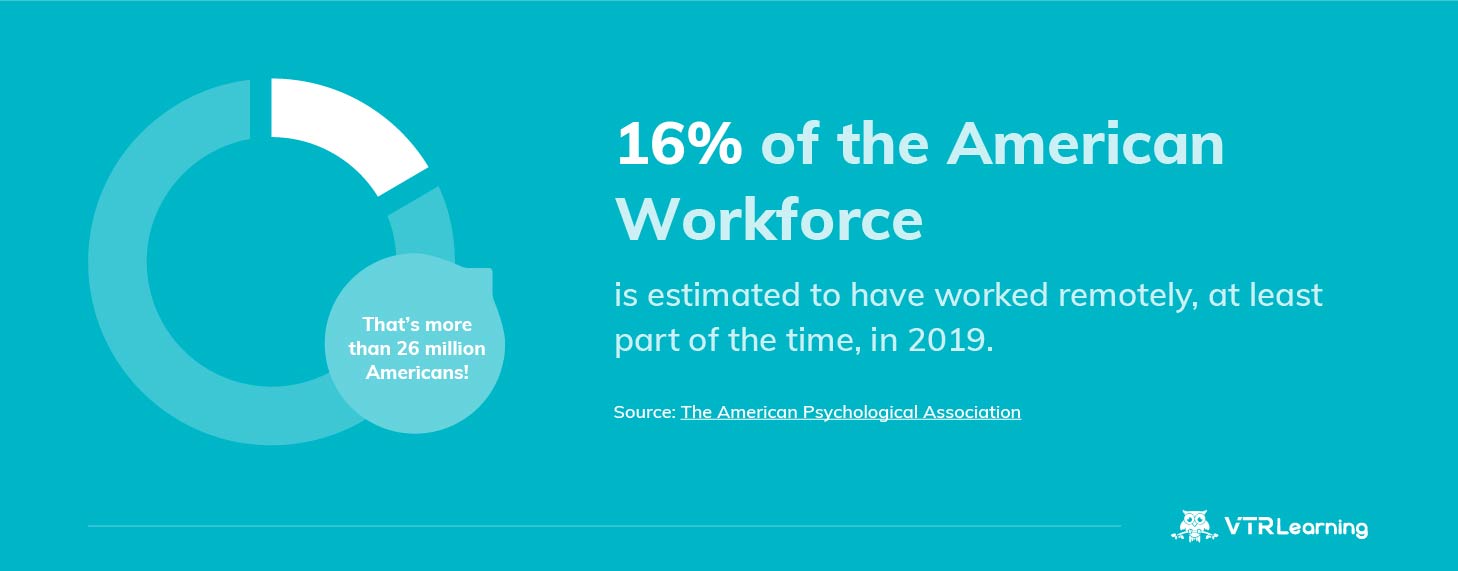

Cloud Accounting Software. Cloud accounting software allows for remote access to your files using any mobile device such as smartphones and tablets. This program is becoming more popular as it can save you space, reduce clutter, makes remote work much easier, and allows you to access your files from anywhere online. There is no need to install any additional software. You just need an Internet connection and a device capable to access cloud storage.

Desktop Accounting Software - Desktop accounting software runs locally on the computer. Like cloud software, desktop software lets you access your files from anywhere, including through mobile devices. However, unlike cloud software, you must install the software on your computer before you can use it.

Mobile Accounting Software is designed to run on smaller devices, such as tablets and smartphones. These apps allow you to manage your finances on the move. They offer fewer functions than desktop programs, but are still useful for those who travel a lot or run errands.

Online Accounting Software is specifically designed for small businesses. It contains all the functions of a traditional desktop application, as well as some additional features. Online software has one advantage: it doesn't require installation. Simply log on to the site and begin using the program. Online software also offers the opportunity to save money as you can avoid local office fees.