A first-time application for a Pennsylvania CPA license can prove difficult. For a license to become an accountant, many states require that you have at least some education, work experience, or continuing education. This can mean that most candidates may take between six and seven year to complete the process. There are some things that you can do to speed the process.

One of the most important things to do is to pass the CPA exam. You will need to pass the CPA exam. This test will assess your accounting skills. But, it will also require you to show good moral character. Many states require that a CPA license be granted after passing an ethics test. It can be helpful to take a few courses in accounting if you don’t have any accounting experience or are not familiar with the requirements to become a CPA.

A bachelor's degree is required to obtain a Pennsylvania CPA license. The degree must be earned at an accredited college or university. Additionally, you will need to have completed at least 120 semester hours of accounting, taxation, finance, law, or finance. You may be eligible to earn up to 30 credit hours if you have an existing degree.

You can also complete a master's in accounting or an online course in accounting to get 120 credits. A Temporary Practice Permit is available for license holders who are not from Pennsylvania. This permits you to work 500 hours in Pennsylvania for 12 months. If you are working for one non-recurring job, the license can be renewed for 500 hours.

The Board offers an online Certified Public Accountant Certification Application. This application must be submitted along with a payment fee. It is possible that you will need to submit criminal references from other states. A form for disability accommodation may be required to accompany the application. You have two options to submit the application: online or mail. It takes approximately three to six months to receive a Notice to Schedule. Within six months of the submission of your application, you will need to schedule an exam.

Additionally, you must pass all four sections on the CPA Exam with at least 75 points. CPA Examination Services, operated by the National Association of State Boards of Accountancy, will assess you. You will also need to complete a pre-evaluation if you are unsure about your education. This will help you identify academic deficiencies before you apply for your license. If you need help preparing for the CPA exam, Wiley's CPA Review Course is a good resource. There are also answers to most common questions on the Board’s website.

Before you apply for a Pennsylvania CPA licence, you will need to complete all necessary paperwork. You may need to complete the following paperwork: a license application; verification of employment; criminal reference checks; and a copy or your degree. Once you have completed all paperwork, you need to submit it to the State Board of Accountancy to be processed.

FAQ

What's the difference between a CPA or Chartered Accountant?

A chartered accountant is a professional accountant who has passed the exams required to obtain the designation. Chartered accountants have more experience than CPAs.

Chartered accountants also have the ability to provide tax advice.

To complete a chartered accountant course, it takes about 6 years.

What is the significance of bookkeeping and accounting

Accounting and bookkeeping are essential for every business. They are essential for any business to keep track and monitor all transactions.

These items will also ensure that you don't spend too much on unnecessary items.

It is important to know the profit margin from each sale. You will also need to know who you owe.

If you don’t have enough money, you might think about raising the prices. You might lose customers if you raise prices too much.

You might consider selling off inventory that is larger than you actually need.

You could reduce your spending if you have more than you need.

All these factors can impact your bottom line.

Why is reconciliation so important?

It's important, as mistakes are possible at any moment. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems can have grave consequences, including incorrect financial statements or missed deadlines, overspending and bankruptcy.

What is the difference in accounting and bookkeeping?

Accounting is the study of financial transactions. These transactions are recorded in bookkeeping.

They are both related, but different activities.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

To report on an organization's financial situation, bookkeepers will keep financial information.

They ensure all books balance by correcting entries in accounts payable and accounts receivable.

Accountants examine financial statements in order to determine whether they conform with generally accepted accounting practices (GAAP).

They may suggest changes to GAAP if they do not agree.

Bookskeepers record financial transactions in order to allow accountants to analyze it.

Statistics

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

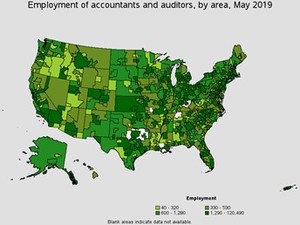

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to get a Accounting degree

Accounting is the recording and keeping track of financial transactions. It can be used to record transactions between individuals and businesses. The term account refers to bookskeeping records. These data help accountants create reports to aid companies and organizations in making decisions.

There are two types: general (or corporate) and managerial accounting. General accounting focuses on the reporting and measurement of business performance. Management accounting deals with the management, analysis, as well as monitoring, of organizational resources.

Accounting bachelor's degrees prepare students to become entry-level accountants. Graduates may choose to specialize such areas as taxation, auditing, finance, or management.

A good knowledge of the basics of economics is essential for students who wish to study accounting. This includes cost-benefit analysis and marginal utility theory. Consumer behavior and price elasticity are just a few examples. They must also understand microeconomics, macroeconomics, international trade, accounting principles, and various accounting software packages.

A Master's degree in Accounting requires that students have successfully completed six semesters worth of college courses. These include Microeconomic Theory, Macroeconomic Theory. International Trade. Business Economics. Financial Management. Auditing Principles & Procedures. Accounting Information Systems. Cost Analysis. Taxation. Human Resource Management. Finance & Banking. Statistics. Mathematics. Computer Applications. English Language Skills. Graduate Level Examinations are required for all students. This examination is usually taken after the completion of three years of study.

For certification as public accountants, candidates must have completed four years of undergraduate and four year of postgraduate education. The candidates must pass additional exams before being eligible to apply for registration.