There are many types business frauds. This article will only focus on four. These frauds include Asset misappropriation, False invoices, Cash larceny, and Skimming. These crimes can be very serious and you need to know how you can prevent yourself from being a victim. Here are some examples. You might be surprised to know that there are many more. You may be shocked at how easy one of these crimes could compromise your business.

Asset misappropriation

Asset misappropriation is most often committed by employees working in the accounting department. These employees have direct financial access and access to company money. These employees may also be motivated by personal financial problems or a negative relationship. While higher-ranking employees are more likely to be victims of this fraud, lower-ranking employees could also be involved. The signs to watch for are excessive irritability as well as addiction.

Asset misappropriation is another type of fraud in business. Employees can use company assets to their personal advantage. Cash misappropriation is easier to identify than non-cash misappropriation, but either type of misappropriation can impede cash flow. Misappropriation on a large scale can result in fines or penalties. The first step in preventing asset theft is to stop it.

False invoices

Fraudsters target companies on the basis of their size, geographic location, and supplier listing. They produce fake invoices that look genuine except for a few small discrepancies. These invoices often get sent to businesses within a short time frame, as Accounts Receivable departments are constantly playing catchup. False invoicing is a sign fraud and should always be investigated. Here are some tips for detecting false invoices and preventing them from happening.

Invoice fraud occurs when a hacker gains access to an email address of a trusted business partner. They then monitor transactions between business partners and their payment processing. They send a convincing bill to the company, which often requires a wire transfer. Even if the invoice is legitimate, the business accounting office may not be aware of it. False invoices can cost you thousands of dollars. Employees could be targeted by criminals to get sensitive information, such as email addresses of decision-makers.

Cash larceny

There are various ways in which a company can be cheated out of cash. One common method is the theft of company assets. This type of business fraud occurs most often in businesses that sell product and have extensive inventories. These frauds can be discovered when businesses stock-take or notice that certain items are missing in their stores. To prevent these frauds from happening, businesses should rotate cash handling employees and not assign all financial tasks to one person.

Another common way of preventing this type of business fraud is to have surprise cash counts. Cash can be used to pay employees, but they may not be aware that the cash is being stolen from the store. Surprise cash counts may also be a good way to prevent larceny. Cash larceny is more difficult to detect than skimming. However, this type business fraud should not be ignored.

Skimming

A visible presence at cash-entry points is a common way of preventing skimming. Cameras can be placed in cash registers or mailrooms to catch unscrupulous employees. This will encourage employees avoid skimming. This tactic won't stop all skimmers. They may be able to find another opportunity, even if they are convicted of the crime. The best thing to do is invest in security measures.

Skimming is a type business scam where a portion of the cash taken from receipts is used for personal purposes. This is common in small businesses that have the owner as the cashier. Skimming is a tax fraud. Skimming is difficult to detect so most companies will find the problem either by accident or suspicion. A business may start to suspect skimming if cash is scarce. It might then hire a Certified Fraud Examiner.

Lapping

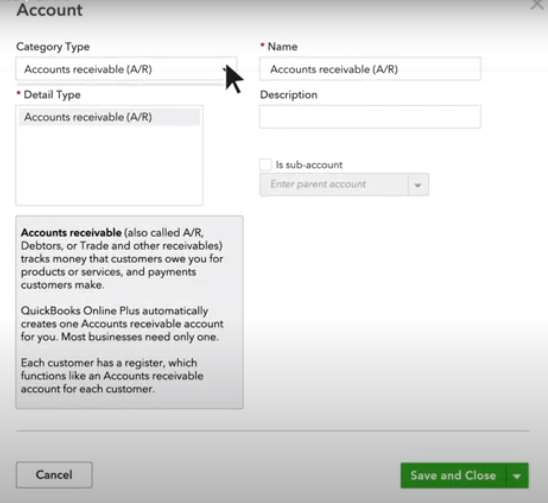

"Lapping" is a common type of accounts receivable theft. In this scheme, an employee steals money from a customer and writes subsequent checks to cover the missing funds. The employee must monitor all accounts to ensure no customer is harmed. Because each customer may have a unique ID, the clerk's accounting records won't show theft. The accounting records of the company won't reveal that an employee robbed a customer.

One way to detect lapping is to examine the receipts. A lapping scheme is one in which a receipt matches a fraudulent account. If you see a pattern of duplicate receipts, this could indicate that the employee is trying to launder money. Lapping schemes may last months or even years. A company may not detect a single transaction before it investigates for other indicators of fraud. One red flag is slow payment posting.

FAQ

How long does it take for an accountant to become one?

Passing the CPA examination is essential to becoming an accountant. Most people who desire to become accountants study approximately four years before they sit down for the exam.

After passing the test, one has to work for at least 3 years as an associate before becoming a certified public accountant (CPA).

What does an auditor do?

Auditors look for inconsistencies between financial statements and actual events.

He confirms the accuracy and completeness of the information provided by the company.

He also checks the validity of financial statements.

What is the purpose and function of accounting?

Accounting is a way to see a financial picture by recording, analyzing and reporting transactions between people. It enables organizations to make informed decisions regarding how much money they have available for investment, how much income they are likely to earn from operations, and whether they need to raise additional capital.

Accountants record transactions in order to provide information about financial activities.

The company can then plan its future business strategy, and budget using the data it collects.

It is important that the data you provide be accurate and reliable.

Statistics

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- In fact, a TD Bank survey polled over 500 U.S. small business owners discovered that bookkeeping is their most hated, with the next most hated task falling a whopping 24% behind. (kpmgspark.com)

External Links

How To

How to get a degree in accounting

Accounting is the art of keeping track and recording financial transactions. Accounting can include recording transactions made by individuals, companies, or governments. Bookkeeping records are also included under the term "account". These data help accountants create reports to aid companies and organizations in making decisions.

There are two types accounting: managerial and general accounting. General accounting deals with reporting and measuring business performance. Management accounting deals with the management, analysis, as well as monitoring, of organizational resources.

An accounting bachelor's degree prepares students for entry-level positions as accountants. Graduates can also opt to specialize in areas such as auditing, taxation or finance management.

Accounting is a career that requires a solid understanding of economic concepts like supply and demand and cost-benefit analysis. Marginal utility theory, consumer behavior, price elasticity of demand and law of one price are all important. They will need to be familiar with accounting principles and different accounting software.

For students to pursue a Master's in Accounting, they must have completed at minimum six semesters of college courses including Microeconomic Theory; Macroeconomic Theory and International Trade; Business Economics. Graduate Level Examination is also required. This examination is usually taken after the completion of three years of study.

For certification as public accountants, candidates must have completed four years of undergraduate and four year of postgraduate education. After passing the exams, candidates can apply to register.