To become a bookkeeper, it is important to take one of the many course available. This article will explain how to start, what courses are available and what the prerequisites and costs are. You have many great options if you are interested in getting your certificate online. You can start by enrolling in the Bookkeeper Launch class. This course is approximately five hours per semaine and takes approximately four months. Once you have graduated, you will earn a certification which increases the credibility of your services. Bookkeeper Business Coach is also an option. It walks you through creating a website and setting up an LLC. You will also learn the basics of marketing such as choosing a name and getting a business license.

Online bookkeeping courses

If you've always dreamed of a career in bookkeeping, you can now take your training online. You can choose between virtual and live online courses. You can access your instructor online anytime you have an internet connection. Online courses are interactive and hands-on, similar to classrooms. You can ask questions to the instructor and interact with other students, too. For the best online bookkeeping classes you can join a team with professors or other students.

Enrolling in online bookkeeping classes will help you understand the basics of bookkeeping. This includes how to invoice others, track expenses and understand financial statements. You will also learn the 5 W’s of bookkeeping. This will make it easier to work with external help. Online classes are a great option for busy professionals who want to learn whenever they like.

Prerequisites

There are a variety of prerequisites for bookkeeper classes. Many of these classes require computer skills, and a thorough study guide. It is possible to save substantial money by purchasing a complete package which includes all of your textbooks and educational materials. Many online learning platforms offer a free trial. If you purchase the entire package, you will save even more. Traditional education institutions can cost thousands of money, so make sure you are aware of the costs before enrolling for bookkeeper classes.

You don't need to be a certified bookkeeper in order to enroll in any training programs. This certification will allow you to use CPB as a mark of achievement on your marketing materials and give you the right for your name to be referred to as CPB. Many bookkeeper certification programs provide access to certified instructors who are experts in bookkeeping. You can learn more about these programs by checking out the U.S. Career Institutes' Bookkeeping Specialist program or UCLA Extension's Certified Bookkeeper program.

Cost

It is important to remember that not all bookkeeper classes are free. Some schools will charge an hourly tuition fee. However, this is not always the norm. You will need to pass a certification exam in order to obtain a bookkeeper certificate from an ACCA accredited body. These certification exams can run anywhere from $100 up to $500. It may be worthwhile to obtain a certificate for bookkeeping. You will need to pay for the license, exam, certification.

The majority of bookkeeper training courses will cover basic accounting and bookkeeping. This course will teach you the basics of accounting, financial statements, principles, and vocabulary. There are also some online courses that cover more advanced topics, such as accounting software. Regardless of the cost, bookkeeper training is an excellent way to learn more about the field. In addition to learning about the fundamentals of accounting, bookkeeper training programs are affordable and flexible. You will need to know the basics of accounting in order to get a grasp on the details.

Instructional courses

There are numerous benefits to online bookkeeper classes taught by instructors. Online bookkeeper classes are simple to follow. Many courses also come with tools that can help students set goals, make a schedule, and plan their learning. Students can engage with professors, students in the same program, and student services staff. Students can gain valuable insight from their instructors. They can also benefit from online courses if they aren't comfortable working with instructors.

For an online version of bookkeeper courses, consider the Accounting Skills Training Institute. Its course curriculum focuses on basic accounting and bookkeeping, with lessons on topics such as trial balance, ledger accounts, and control and cashbooks. There are also downloadable resources available for practice. Online bookkeeper classes can be taken by instructors and you can earn certification. These courses often offer hands-on instruction and are usually free.

FAQ

What training is needed to become an accountant?

Basic math skills are required for bookkeepers. These include addition, subtraction and multiplication, divisions, fractions, percentages and simple algebra.

They also need to know how to use a computer.

Many bookkeepers are graduates of high school. Some may even hold a college degree.

What is a Certified Public Accountant?

A C.P.A. is a certified public accountant. An accountant with specialized knowledge is one who has been certified as a public accountant (C.P.A.). He/she has the ability to prepare tax returns, and assist businesses in making sound business decision.

He/She monitors cash flow for the company and makes sure the company runs smoothly.

What are the benefits of accounting and bookkeeping?

Bookkeeping and accounting are important for any business. They allow you to keep track of all transactions and expenses.

They also make it easier to save money on unnecessary purchases.

You need to know how much profit you've made from each sale. It is also important to know how much you owe others.

If you don’t have enough money, you might think about raising the prices. If you raise them too high, though, you might lose customers.

You may be able to sell some inventory if you have more than what you need.

If you don't have enough, you can cut back on some services or products.

All these factors can impact your bottom line.

What does reconcile account mean?

A reconciliation is the comparison of two sets. One set of numbers is called the source, and the other is called reconciled.

Source consists of actual figures. The reconciled is the figure that should have been used.

For example, suppose someone owes $50 but you only get $50. You would subtract $50 from $100 to reconcile the situation.

This process ensures that there aren't any errors in the accounting system.

What are the different types of bookkeeping systems?

There are three main types in bookkeeping: computerized (manual), hybrid (computerized) and hybrid.

Manual bookkeeping means using pen and paper to maintain records. This method requires attention to every detail.

Software programs are used for computerized bookkeeping to manage finances. It is time- and labor-savings.

Hybrid bookkeeping combines both manual and computerized methods.

Statistics

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

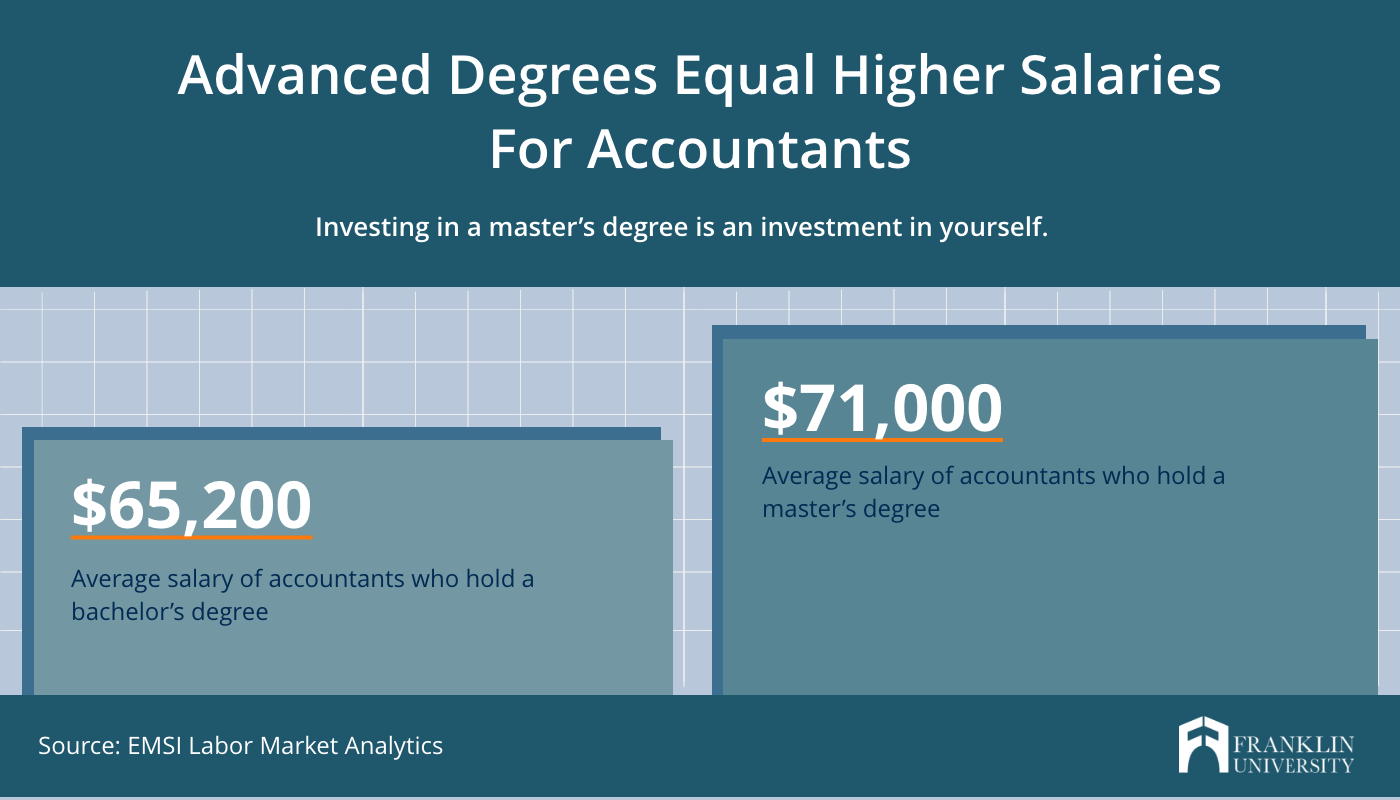

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- The U.S. Bureau of Labor Statistics (BLS) projects an additional 96,000 positions for accountants and auditors between 2020 and 2030, representing job growth of 7%. (onlinemasters.ohio.edu)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

How to do Accounting for Small Business

Accounting for small businesses can be a crucial part of any business's management. This includes tracking income and expenses, preparing financial statements, and paying taxes. It also involves the use of various software programs such as Quickbooks Online. There are several ways to do small business accounting. You need to choose the most appropriate method for your business. Here are some top options that you can consider.

-

The paper accounting method is recommended. You may prefer paper accounting if you are looking for simplicity. This method is very simple. You simply need to record transactions every day. If you are looking to ensure that your records are accurate and complete, you may want to consider QuickBooks Online.

-

Use online accounting. Online accounting allows you to access your accounts from anywhere and at any time. Wave Systems, Freshbooks and Xero are all popular choices. These software allows you to manage your finances and generate reports. These software are simple to use and offer many great benefits and features. These programs are a great way to save time and cash on your accounting.

-

Use cloud accounting. Another option is cloud accounting. You can store your data securely on a remote server. Cloud accounting offers many benefits over traditional accounting systems. Cloud accounting doesn't require expensive hardware and software. Your information is kept remotely and offers you better security. It eliminates the need to back up your data. Fourth, you can share your files with others.

-

Use bookkeeping software. Bookkeeping software is similar in function to cloud accounting. You will need to purchase a computer and then install the software. Once you have installed the software, the software will allow you to connect to the Internet so you can access your accounts whenever it suits you. You can also view your balances and accounts right from your computer.

-

Use spreadsheets. Spreadsheets can be used to manually enter financial transactions. You can, for example, create a spreadsheet that allows you to enter sales figures each day. Another benefit of using a spreadsheet is the ability to make changes at will without needing an entire update.

-

Use a cash book. A cashbook allows you to record every transaction. Cashbooks can come in different sizes depending on how much space is available. You can either keep separate notebooks for each month or one that spans several months.

-

Use a check register. A check register can be used to organize receipts, payments, and other information. You simply need to scan the items you receive into your scanner and then transfer them to your register. Notes can be added to the items once they are scanned.

-

Use a journal. A journal is a type of logbook that keeps track of your expenses. This is especially useful if you have frequent recurring expenses such rent, utilities, and insurance.

-

Use a diary. A diary is simply a journal that you write to yourself. You can use it as a way to keep track and plan your spending habits.