Having an accounting degree is not mandatory for a successful career. An accounting degree is not required to work as an accountant. However, it will be helpful if you are looking for a job. Accounting degrees will enable you to study about accounting, auditing, taxation and business finance. While your education may not lead directly to a high-paying job, it will give you a strong foundation for a successful career in accounting. You'll also be able apply your knowledge in real-world situations.

A four-year accounting degree will equip you with the required background to work in many accounting fields. You can choose to specialize in auditing or taxation. After you complete your degree, it is possible to sit for the CPA exams. While not required for most accounting jobs, it can be useful for corporate employees who are interested. Master of Accounting (M.A. ), Master of Business Administration(MBA) or Master of Finance degree.

Many schools offer an accounting degree. Most colleges and universities offer accounting or bookkeeping courses. Many colleges offer internships for students who are interested in a career. These internships give you an idea of the job market after graduation. During your fifth year, you can also take part in an academic concentration. Colleges may even arrange for professionals to speak in your class. These opportunities allow you to gain real-world experience, develop leadership skills, and apply what you learned in class to your real-world career.

Accounting programs that are well-designed will help you understand the basics. Additionally, you will need to take additional 30 hours of coursework to get more in-depth accounting knowledge. The best degree programs will help you think critically about financial data. You will also learn the working logic of software. You will also learn how to communicate financial data to non-accounting audiences.

There are several accounting organizations that help new and experienced accountants with networking, learning opportunities, and insights into the profession. These organizations can also help with finding a job. If you're just starting your career, it might be worth looking into internships with a reputable accountant firm. Many accounting companies will offer internships at your school. However, not all companies visit all campuses. To find out more about the recruitment process, it is a good idea to get in touch with your professors.

The accounting industry has also benefited from advances in technology, especially in the field of artificial intelligence. Accountants are able to apply analytics and cutting-edge technology to their work, allowing them to make more impactful decisions. The most important accounting positions require creativity and a high degree of knowledge. An accountant is not just an expert in math. They also have the ability to use their knowledge to make better decisions. An accountant who is competent in using data and information ethically will be able use it efficiently and can spot financial mistakes before they happen.

FAQ

Why Is Accounting Useful for Small Business Owners?

The most important thing you need to know about accounting is that it's not just for big businesses. It is useful for small-business owners as it helps them track all the money that they spend and make.

If your business is small, you already know how much money each month you make. But what if your accountant doesn't do this for a monthly basis? You might be wondering about your spending habits. It is possible to forget to pay your bills on a timely basis, which can negatively affect your credit rating.

Accounting software makes it easy for you to keep track and manage your finances. There are many options. Some are free and others can be purchased for hundreds or thousands of dollar.

It doesn't matter which accounting system you use; you need to know its basic functions. It will save you time and help you understand how to use it.

These are the basics of what you should do:

-

You can enter transactions into your accounting system.

-

Keep track of your income and expenses.

-

Prepare reports.

After you have mastered these three points, you can start to use your new accounting software.

What is the difference between a CPA (Chartered Accountant) and a CPA (Chartered Accountant)?

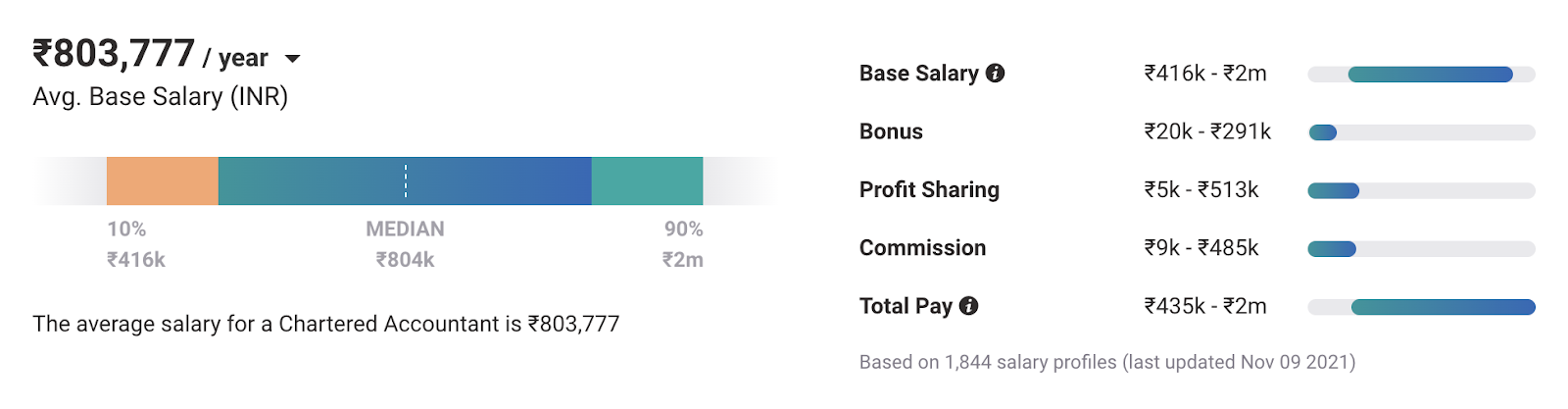

Chartered accountants are accountants who have passed all the necessary exams to get the designation. A chartered accountant is usually more experienced than a CPA.

A chartered accountant also holds himself out as being able to give advice regarding tax matters.

To complete a chartered accountant course, it takes about 6 years.

What happens to my bank statement if it is not reconciled?

If you fail to reconcile your bank statement, you may not realize that you've made a mistake until after the end of the month.

You will have to repeat the whole process.

Statistics

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- Given that over 40% of people in this career field have earned a bachelor's degree, we're listing a bachelor's degree in accounting as step one so you can be competitive in the job market. (yourfreecareertest.com)

External Links

How To

How to Become a Accountant

Accounting is the science and art of recording financial transactions and analyzing them. Accounting also includes the preparation of statements and reports for different purposes.

A Certified Public Accountant, also known as a CPA, is someone who has successfully passed the CPA exam. They are licensed by the state's board of accountancy.

An Accredited Financial Advisor (AFA), is an individual that meets certain criteria established by American Association of Individual Investors. A minimum five-year investment history is required in order to be an AFA according to the AAII. A series of exams is required to assess their knowledge of securities analysis and accounting principles.

A Chartered Professional Accountant, also known as a chartered accountant or chartered accountant, a professional accountant who holds a degree from a recognized university. The Institute of Chartered Accountants of England & Wales (ICAEW) has established specific educational standards for CPAs.

A Certified Management Accountant, also known as a CMA, is a certified professional who specializes on management accounting. CMAs have to pass exams administered by ICAEW and keep up-to-date with continuing education requirements throughout the course of their careers.

A Certified General Accountant (CGA) member of the American Institute of Certified Public Accountants (AICPA). CGAs are required take several exams. The Uniform Certification Examination is one of them.

International Society of Cost Estimators has awarded the certification of Certified Information Systems Auditor. Candidates for the CIA need to complete three levels in order to be eligible. These include practical training, coursework and a final examination.

Accredited Corporate Compliance Office (ACCO), a designation conferred by the ACCO Foundation as well as the International Organization of Securities Commissions. ACOs need to have a bachelor's degree in finance, public policy, or business administration. They must also pass two written exams as well as one oral exam.

A credential issued by the National Association of State Boards of Accountancy is called a Certified Fraud Examiner. Candidates must pass three exams and obtain a minimum score of 70 percent.

A Certified Internal Auditor (CIA) is accredited by the International Federation of Accountants (IFAC). The International Federation of Accountants (IFAC) requires that candidates pass four exams. These include topics such as auditing and risk assessment, fraud prevention or ethics, as well as compliance.

American Academy of Forensic Sciences gives Associate in Forensic Accounting (AFE), a designation. AFEs must be graduates of an accredited college or university that has a bachelor's in accounting.

What is an auditor? Auditors are professionals who perform audits of financial reporting systems and their internal controls. Audits can be conducted randomly or based upon complaints from regulators regarding the organization's financial reports.